Investigating Stock Prediction with RNN

Investigating Stock Prediction with RNN

Overview

A recurrent neural network uses its internal state to process sequential inputs, which makes it great for time series data such as stock prices. LSTM has become the most popular technique on the Internet for machine learning stock prediction. Many claim to have astonishing accuracies. In this blog post, we will investigate the popular LSTM, long short-term memory, method for stock prediction.

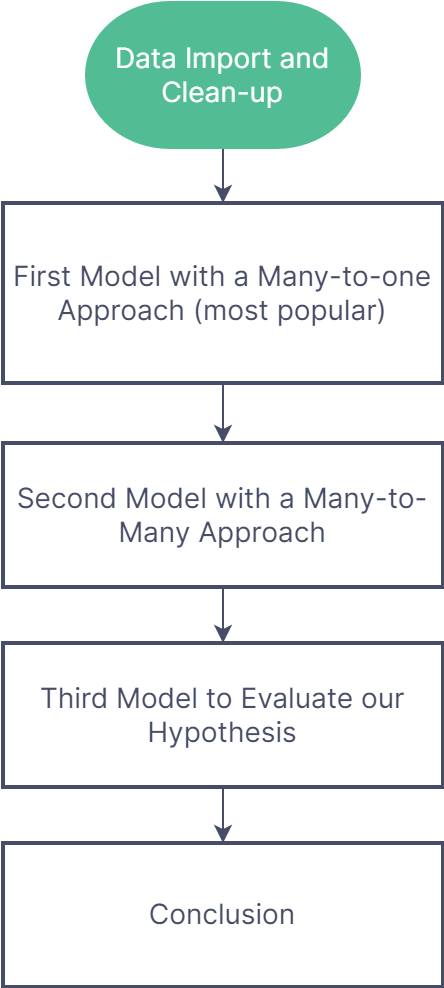

We will construct in total three models using LSTM. The first one predicts one data point using multiple, which is the most popular technique and enjoys the most promising accuracy claims. The second model uses a different many-to-many technique for LTSM. Based on the previous two, we propose a hypothesis regarding the effectiveness of LSTM stock predictors and construct a third model to test our claim.

Here is a flow chart of our project.

Here is the link to our GitHub repo. https://github.com/justinlaicy926/PIC16BProject

Data Import and Clean-up

#install yfinance in Colab

!pip install yfinance

#import the required libraries

import pandas as pd

import numpy as np

import keras

import tensorflow as tf

import plotly.graph_objects as go

from keras.preprocessing.sequence import TimeseriesGenerator

import math

import pandas_datareader as web

import numpy as np

import pandas as pd

from datetime import datetime

from sklearn.preprocessing import MinMaxScaler

import matplotlib.pyplot as plt

from pandas_datareader import data as pdr

import yfinance as yfin

from keras.models import Sequential

from keras.layers import LSTM, Dense, Dropout

import plotly.graph_objects as go

from sklearn.preprocessing import StandardScaler

from tensorflow.keras.optimizers import Adam

from plotly.io import write_html

import datetime as dt

from datetime import datetime

from keras.callbacks import ReduceLROnPlateau, ModelCheckpoint, TensorBoard

import model_helper

#yfinance api call to import data

yfin.pdr_override()

df = pdr.get_data_yahoo("^GSPC ^VIX", start="2002-01-01", end="2022-05-03")

[*********************100%***********************] 2 of 2 completed

#data cleanup

df["sp500"] = df["Adj Close"]["^GSPC"]

df["volume"] = df["Volume"]["^GSPC"]

df["vix"] = df["Adj Close"]["^VIX"]

df = df.reset_index()

df = df.drop(columns = ["Adj Close", "Volume"])

df = df.drop(columns = ["Close", "High", "Low", "Open"])

df.head()

/usr/local/lib/python3.7/dist-packages/pandas/core/generic.py:4150: PerformanceWarning: dropping on a non-lexsorted multi-index without a level parameter may impact performance.

obj = obj._drop_axis(labels, axis, level=level, errors=errors)

| Date | sp500 | volume | vix | |

|---|---|---|---|---|

| 0 | 2002-01-02 | 1154.670044 | 1171000000 | 22.709999 |

| 1 | 2002-01-03 | 1165.270020 | 1398900000 | 21.340000 |

| 2 | 2002-01-04 | 1172.510010 | 1513000000 | 20.450001 |

| 3 | 2002-01-07 | 1164.890015 | 1308300000 | 21.940001 |

| 4 | 2002-01-08 | 1160.709961 | 1258800000 | 21.830000 |

#replace with datetime

df['Date'] = pd.to_datetime(df['Date'])

df.set_axis(df['Date'], inplace=True)

#visualize our data

trace1 = go.Scatter(

x = df["Date"],

y = df["sp500"],

mode = 'lines',

name = 'SP500'

)

layout = go.Layout(

title = "S&P500 Index from 2002 to 2022",

xaxis = {'title' : "Date"},

yaxis = {'title' : "Close"}

)

fig = go.Figure(data=[trace1], layout=layout)

write_html(fig, "sp500.html")

#creates dataset for training and testing purposes

close_data = df['sp500'].values

close_data = close_data.reshape((-1,1))

split_percent = 0.80

split = int(split_percent*len(close_data))

#training and testing

close_train = close_data[:split]

close_test = close_data[split:]

date_train = df['Date'][:split]

date_test = df['Date'][split:]

#this will be the length for our RNN input

look_back = 20

#generate time series using this function

train_generator = TimeseriesGenerator(close_train, close_train, length=look_back, batch_size=20)

test_generator = TimeseriesGenerator(close_test, close_test, length=look_back, batch_size=1)

First Model with Many-to-One LSTM

Let’s make our first model with LSTM. We will be using the many-to-one method, i.e. input 20 data points of data and outputs 1 data point. We will be using the LSTM layers and dropout layers to construct our model.

#make our first model

model = Sequential()

#LSTM layer is the backbone of our RNN

model.add(

LSTM(50,

return_sequences=True,

activation='relu',

input_shape=(look_back,1))

)

model.add(

LSTM(50,

activation='relu',

input_shape=(look_back,1))

)

#dropout layer to prevent overfitting

model.add(Dropout(0.2))

model.add(Dense(1))

model.compile(optimizer='adam', loss='mse')

#fit our data with our model

model.fit_generator(train_generator, epochs=25, verbose=1)

Epoch 1/25

/usr/local/lib/python3.7/dist-packages/ipykernel_launcher.py:21: UserWarning: `Model.fit_generator` is deprecated and will be removed in a future version. Please use `Model.fit`, which supports generators.

204/204 [==============================] - 8s 26ms/step - loss: 307866.7188

Epoch 2/25

204/204 [==============================] - 4s 21ms/step - loss: 130283.4141

Epoch 3/25

204/204 [==============================] - 5s 26ms/step - loss: 92953.8828

Epoch 4/25

204/204 [==============================] - 4s 20ms/step - loss: 86772.0703

Epoch 5/25

204/204 [==============================] - 4s 20ms/step - loss: 83158.5938

Epoch 6/25

204/204 [==============================] - 4s 20ms/step - loss: 77838.5859

Epoch 7/25

204/204 [==============================] - 4s 20ms/step - loss: 77180.0312

Epoch 8/25

204/204 [==============================] - 4s 20ms/step - loss: 78002.9375

Epoch 9/25

204/204 [==============================] - 4s 20ms/step - loss: 86443.7188

Epoch 10/25

204/204 [==============================] - 4s 20ms/step - loss: 78251.7969

Epoch 11/25

204/204 [==============================] - 4s 21ms/step - loss: 74420.1328

Epoch 12/25

204/204 [==============================] - 4s 20ms/step - loss: 78686.7500

Epoch 13/25

204/204 [==============================] - 4s 21ms/step - loss: 75580.6406

Epoch 14/25

204/204 [==============================] - 4s 21ms/step - loss: 80284.8281

Epoch 15/25

204/204 [==============================] - 5s 22ms/step - loss: 76584.8359

Epoch 16/25

204/204 [==============================] - 4s 21ms/step - loss: 77448.7500

Epoch 17/25

204/204 [==============================] - 4s 21ms/step - loss: 74166.5781

Epoch 18/25

204/204 [==============================] - 4s 21ms/step - loss: 75540.6250

Epoch 19/25

204/204 [==============================] - 5s 26ms/step - loss: 74215.9531

Epoch 20/25

204/204 [==============================] - 4s 21ms/step - loss: 71973.0781

Epoch 21/25

204/204 [==============================] - 5s 23ms/step - loss: 76873.0234

Epoch 22/25

204/204 [==============================] - 4s 21ms/step - loss: 75014.7578

Epoch 23/25

204/204 [==============================] - 4s 21ms/step - loss: 77293.1016

Epoch 24/25

204/204 [==============================] - 4s 21ms/step - loss: 116743.6562

Epoch 25/25

204/204 [==============================] - 5s 23ms/step - loss: 138009.0938

<keras.callbacks.History at 0x7f1335e56510>

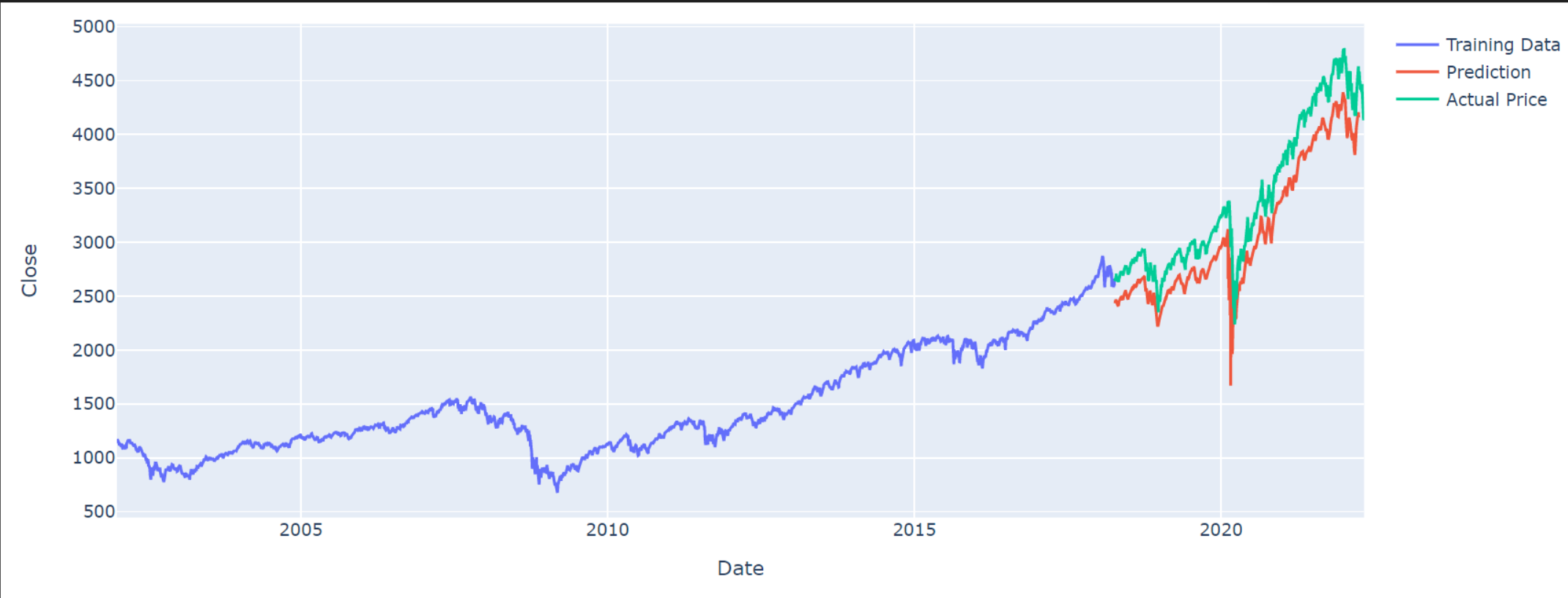

Now let’s see how our model predicts.

#make prediction

prediction = model.predict_generator(test_generator)

#reshape our prediction

close_train = close_train.reshape((-1))

close_test = close_test.reshape((-1))

prediction = prediction.reshape((-1))

#plots the three segments of data points, the training data, the predicted trend, and the actual price

trace1 = go.Scatter(

x = date_train,

y = close_train,

mode = 'lines',

name = 'Training Data'

)

trace2 = go.Scatter(

x = date_test,

y = prediction,

mode = 'lines',

name = 'Prediction'

)

trace3 = go.Scatter(

x = date_test,

y = close_test,

mode='lines',

name = 'Actual Price'

)

layout = go.Layout(

title = "SP500 Prediction",

xaxis = {'title' : "Date"},

yaxis = {'title' : "Close"}

)

fig = go.Figure(data=[trace1, trace2, trace3], layout=layout)

write_html(fig, "prediction1.html")

/usr/local/lib/python3.7/dist-packages/ipykernel_launcher.py:3: UserWarning: `Model.predict_generator` is deprecated and will be removed in a future version. Please use `Model.predict`, which supports generators.

This is separate from the ipykernel package so we can avoid doing imports until

Our model is looking extremely promising. Our model has managed to accurately predict every major turning points in the stock market. If this is real, we would all be billionairs. But is there a catch? It almost looks too good to be true. Let’s see how it performs in the real world.

Making Prediction with Our First Model

We will predict 60 days into the future, 30 days of which is known data (to us, not to the model). Let’s see how our model performs.

#reshape our data

close_data = close_data.reshape((-1))

num_prediction = 60

forecast = predict(num_prediction, model)

forecast_dates = predict_dates(num_prediction)

#imports the actual price for these dates and cleans up

result = pdr.get_data_yahoo("^GSPC ^VIX", start="2022-05-02", end="2022-06-03")

result["sp500"] = result["Adj Close"]["^GSPC"]

result["voulme"] = result["Volume"]["^GSPC"]

result["vix"] = result["Adj Close"]["^VIX"]

result = result.reset_index()

result = result.drop(columns = ["Adj Close", "Volume"])

result = result.drop(columns = ["Close", "High", "Low", "Open"])

result['Date'] = pd.to_datetime(result['Date'])

result.set_axis(result['Date'], inplace=True)

close_data = result['sp500'].values

close_data = close_data.reshape((-1,1))

actual_date = result['Date']

actual_close = close_data

[*********************100%***********************] 2 of 2 completed

/usr/local/lib/python3.7/dist-packages/pandas/core/generic.py:4150: PerformanceWarning:

dropping on a non-lexsorted multi-index without a level parameter may impact performance.

#plots the real-world prediction

trace1 = go.Scatter(

x = forecast_dates,

y = forecast,

mode = 'lines',

name = 'Data'

)

trace2 = go.Scatter(

x = result['Date'],

y = result['sp500'].values,

mode = 'lines',

name = 'Actual Price'

)

layout = go.Layout(

title = "SP500 Prediction",

xaxis = {'title' : "Date"},

yaxis = {'title' : "Close"}

)

fig = go.Figure(data=[trace1, trace2], layout=layout)

With just two months of prediction, we are seeing a significant deviation from the actual price trend. Our model tells us that SP500 will continue tanking for two months, with no significant pullbacks. This is highly unlikely based on experience. The actual price trend, however, is much more reasonable.

Second Model with Many-to-Many RNN

We saw some significant drawbacks with our first model in the real world. It is shocking how good it is with test cases until it performs against unseen data. In this section, we will try to explain this discrepancy with our second model using the many-to-many method.

Instead of feeding our model with 20 data points and extracting one prediction, we will be feeding it with multiple data points and extracting a trend line into the future.

#Data import and cleanup

dataset_train = pd.read_csv('^NDX.csv')

cols = list(dataset_train)[1:]

datelist_train = list(dataset_train["Date"])

datelist_train = [dt.datetime.strptime(date, '%Y-%m-%d').date() for date in datelist_train]

training_set = dataset_train.values

#feature scaling using StandardScalar

sc = StandardScaler()

training_set_scaled = sc.fit_transform(training_set)

#shapes our data

sc_predict = StandardScaler()

sc_predict.fit_transform(training_set[:, 0:1])

array([[-0.703329 ],

[-0.69582021],

[-0.6775205 ],

...,

[ 2.4043269 ],

[ 2.47115722],

[ 2.476595 ]])

For consistency’s sake, we will look into the future for 60 days just like before. But instead of looking back for 20 days, we will likely need more data points. Let’s use 90 days of trading data to predict the next 60 days of prices.

#create our training data set

X_train = []

y_train = []

#predict 60 days with 90 days

n_future = 60

n_past = 90

for i in range(n_past, len(training_set_scaled) - n_future +1):

X_train.append(training_set_scaled[i - n_past:i, 0:dataset_train.shape[1] - 1])

y_train.append(training_set_scaled[i + n_future - 1:i + n_future, 0])

X_train, y_train = np.array(X_train), np.array(y_train)

#Similar deal, sequential model with 2 LSTM models and one dropout

model = Sequential()

model.add(LSTM(units=64,

return_sequences=True,

input_shape=(n_past, dataset_train.shape[1]-1)))

model.add(LSTM(units=10,

return_sequences=False))

model.add(Dropout(0.20))

model.add(Dense(units=1, activation='linear'))

#compile the model

model.compile(optimizer = Adam(learning_rate=0.01), loss='mean_squared_error')

#fit the model

model.fit(X_train, y_train, epochs=20)

#makes the list for prediction

datelist_future = pd.date_range(datelist_train[-1], periods=n_future, freq='1d').tolist()

#makes the list of dates

datelist_future_ = []

for this_timestamp in datelist_future:

datelist_future_.append(this_timestamp.date())

#makes the prediction

predictions_future = model.predict(X_train[-n_future:])

predictions_train = model.predict(X_train[n_past:])

#cleans up the data for visualization

y_pred_future = sc_predict.inverse_transform(predictions_future)

y_pred_train = sc_predict.inverse_transform(predictions_train)

PREDICTIONS_FUTURE = pd.DataFrame(y_pred_future, columns=['Open']).set_index(pd.Series(datelist_future))

PREDICTION_TRAIN = pd.DataFrame(y_pred_train, columns=['Open']).set_index(pd.Series(datelist_train[2 * n_past + n_future -1:]))

PREDICTION_TRAIN.index = PREDICTION_TRAIN.index.to_series()

dataset_train = pd.DataFrame(dataset_train, columns=cols)

dataset_train.index = datelist_train

dataset_train.index = pd.to_datetime(dataset_train.index)

START_DATE_FOR_PLOTTING = '2012-05-01'

trace1 = go.Scatter(

x = PREDICTIONS_FUTURE.index,

y = PREDICTIONS_FUTURE['Open'],

mode = 'lines',

name = 'Predicted Stock Price'

)

trace2 = go.Scatter(

x = PREDICTION_TRAIN.loc[START_DATE_FOR_PLOTTING:].index,

y = PREDICTION_TRAIN.loc[START_DATE_FOR_PLOTTING:]['Open'],

mode = 'lines',

name = 'Training Predictions'

)

trace3 = go.Scatter(

x = dataset_train.loc[START_DATE_FOR_PLOTTING:].index,

y = dataset_train.loc[START_DATE_FOR_PLOTTING:]['Open'],

mode = 'lines',

name = 'Actual Stock Prices'

)

layout = go.Layout(

title = "NQ100 Prediction",

xaxis = {'title' : "Date"},

yaxis = {'title' : "Close"}

)

fig = go.Figure(data=[trace1, trace2, trace3], layout=layout)

write_html(fig, "prediction3.html")

This looks nothing like before. Our model has completely failed to predict the upward rally beginning march 2020. In fact, it has failed to predict any breakage of establish trend. It appears it is trained to stick to existing trends in an effort to maximize accuracy. This model is useless in the real world.

But what causes the stark difference between our first and second model? In a many-to-many model tested against seen data, the model is always tasked with predicting the next day. It is easy to guess the next data point as stock prices are relatively continuous, and our model can always guess some number close. Since we are testing with seen data, any miscalculation does not add up. But when facing unseen prediction, our model fails. The second model is a clear demonstration of how our model fails to predict any change in price trends.

Third Model

We hypothesize that our RNN model is simply adhering to the most dominant trend. Instead of prediction based on identifying trends and patterns, which was expected from RNN, it is acting more of a regression role. Thus, we decide to conduct a third model based on data points from March 2020 to present day.

During this time period, aggresive monetary and fiscal policies reshaped market. The resulting stock market performance deviated from the pre-established trends for over a decade. If our hypothesis is true, our third model will guess the stock market will stcik to a never ending upward rally.

Model 3 is exactly the same as our previous model, except trained with localized data.

yfin.pdr_override()

df = pdr.get_data_yahoo("^GSPC ^VIX", start="2020-03-15", end="2022-06-05")

df = df.reset_index()

[*********************100%***********************] 2 of 2 completed

df.head()

dataset_train = pd.concat([df['Date'],df['Open']['^GSPC'],df['High']['^GSPC'],df['Low']['^GSPC'],df['Close']['^GSPC'],df['Adj Close']['^GSPC'],df['Volume']['^GSPC']],axis=1)

dataset_train.columns=["Date","Open","High","Low","Close","Adj Close","Volume"]

cols = list(dataset_train)[1:]

datelist_train = list(dataset_train['Date'])

datelist_train = [dt.datetime.strptime(str(date), '%Y-%m-%d %H:%M:%S').date() for date in datelist_train]

training_set = dataset_train[cols].astype(str)

training_set = training_set.astype(float)

training_set = training_set.values

training_set

array([[2.50859009e+03, 2.56297998e+03, 2.38093994e+03, 2.38612988e+03,

2.38612988e+03, 7.78154000e+09],

[2.42565991e+03, 2.55392993e+03, 2.36704004e+03, 2.52918994e+03,

2.52918994e+03, 8.35850000e+09],

[2.43650000e+03, 2.45357007e+03, 2.28052002e+03, 2.39810010e+03,

2.39810010e+03, 8.75578000e+09],

...,

[4.14977979e+03, 4.16654004e+03, 4.07385010e+03, 4.10122998e+03,

4.10122998e+03, 4.14571000e+09],

[4.09540991e+03, 4.17750977e+03, 4.07437012e+03, 4.17681982e+03,

4.17681982e+03, 3.60493000e+09],

[4.13756982e+03, 4.14266992e+03, 4.09866992e+03, 4.10854004e+03,

4.10854004e+03, 3.10708000e+09]])

sc = StandardScaler()

training_set_scaled = sc.fit_transform(training_set)

sc_predict = StandardScaler()

sc_predict.fit_transform(training_set[:, 0:1])

# Creating a data structure with 90 timestamps and 1 output

X_train = []

y_train = []

n_future = 60

n_past = 90

for i in range(n_past, len(training_set_scaled) - n_future +1):

X_train.append(training_set_scaled[i - n_past:i, 0:dataset_train.shape[1] - 1])

y_train.append(training_set_scaled[i + n_future - 1:i + n_future, 0])

X_train, y_train = np.array(X_train), np.array(y_train)

print('X_train shape == {}.'.format(X_train.shape))

print('y_train shape == {}.'.format(y_train.shape))

X_train shape == (412, 90, 6).

y_train shape == (412, 1).

model = Sequential()

model.add(LSTM(units=64, return_sequences=True, input_shape=(n_past, dataset_train.shape[1]-1)))

model.add(LSTM(units=10, return_sequences=False))

model.add(Dropout(0.25))

model.add(Dense(units=1, activation='linear'))

model.compile(optimizer = Adam(learning_rate=0.01), loss='mean_squared_error')

rlr = ReduceLROnPlateau(monitor='val_loss', factor=0.5, patience=10, verbose=1)

mcp = ModelCheckpoint(filepath='weights.h5', monitor='val_loss', verbose=1, save_best_only=True, save_weights_only=True)

tb = TensorBoard('logs')

history = model.fit(X_train, y_train, shuffle=True, epochs=30, callbacks=[rlr, mcp, tb], validation_split=0.2, verbose=1, batch_size=256)

datelist_future = pd.date_range(datelist_train[-1], periods=n_future, freq='1d').tolist()

datelist_future_ = []

for this_timestamp in datelist_future:

datelist_future_.append(this_timestamp.date())

predictions_future = model.predict(X_train[-n_future:])

predictions_train = model.predict(X_train[n_past:])

y_pred_future = sc_predict.inverse_transform(predictions_future)

y_pred_train = sc_predict.inverse_transform(predictions_train)

PREDICTIONS_FUTURE = pd.DataFrame(y_pred_future, columns=['Open']).set_index(pd.Series(datelist_future))

PREDICTION_TRAIN = pd.DataFrame(y_pred_train, columns=['Open']).set_index(pd.Series(datelist_train[2 * n_past + n_future -1:]))

# Convert <datetime.date> to <Timestamp> for PREDCITION_TRAIN

PREDICTION_TRAIN.index = PREDICTION_TRAIN.index.to_series().apply(datetime_to_timestamp)

PREDICTION_TRAIN

trace1 = go.Scatter(

x = PREDICTIONS_FUTURE.index,

y = PREDICTIONS_FUTURE['Open'],

mode = 'lines',

name = 'Predicted Stock Price'

)

trace2 = go.Scatter(

x = PREDICTION_TRAIN.index,

y = PREDICTION_TRAIN['Open'],

mode = 'lines',

name = 'Training Predictions'

)

trace3 = go.Scatter(

x = dataset_train['Date'],

y = dataset_train['Open'],

mode = 'lines',

name = 'Actual Stock Prices'

)

layout = go.Layout(

title = "NQ100 Prediction",

xaxis = {'title' : "Date"},

yaxis = {'title' : "Close"}

)

fig = go.Figure(data=[trace1, trace2, trace3], layout=layout)

fig.show()

write_html(fig, "prediction4.html")

It appears our model has performed exactly as we have hypothesized. In other words, our use of RNN fails to predict significant trend movements to enable profitable trades. Instead of prediction, our model excels at regression.

Conclusion

Our many-to-many model shows the real-world usefulness, or the lack thereof, of modelling stock prices using RNN. We remain skeptical of technical analysis doctrince based on price trend analysis.

Despite our search for a reliable technical analysis RNN model has failed, it is insufficient to conclude the merit of all technical analysis methods. More in-depth experimentation is needed.